Borrowers seeking to have up to $20,000 in student debt canceled have until November 15 to submit their applications, according to the U.S. Department of Education.

Last month, President Joe Biden announced that most federal student loan borrowers will be eligible for some forgiveness. Most borrowers who did not receive a Pell Grant will be eligible to have $10,000 cancelled. Those who were granted a Pell Grant are eligible to have $20,000 in student loan debt erased.

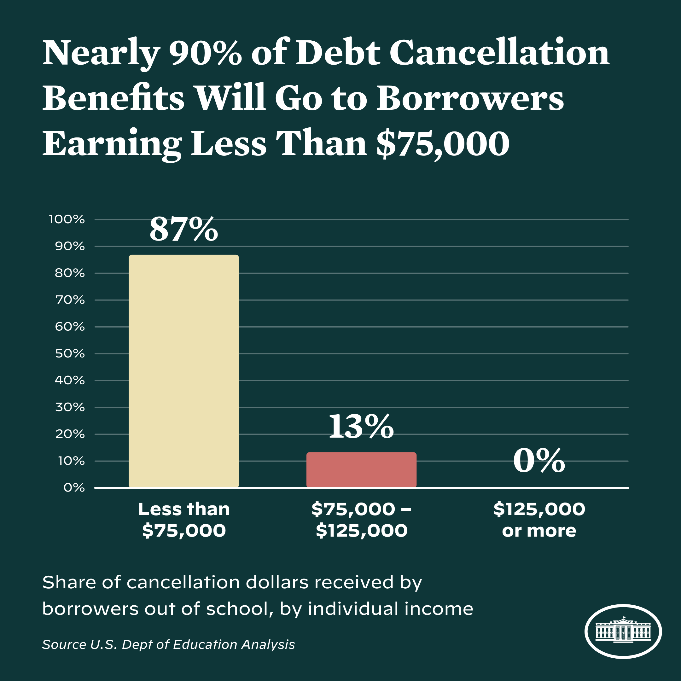

To be eligible for relief, individuals must make less than $125,000 per year and married couples or heads of households must earn less than $250,000 annually.

About 37 million borrowers will be eligible for the forgiveness based on their loan type (and then as long as they also fall under the income cap), because their debt is under what’s called the William D. Ford Federal Direct Loan Program. That includes Direct Stafford Loans, and all direct subsidized and unsubsidized federal student loans.

Department officials said they have made the application process simple, and if borrowers fail to apply by November 15, they would still have until the end of 2023 to file for forgiveness.

However, by waiting until after November 15, borrowers risk having to resume payments after the federal pause in repayment ends on December 31.

Biden said it’s vital for the more than 43 million eligible borrowers to take advantage of the loan forgiveness plan.

“All this means is people can start to finally crawl out from under that mountain of debt to get on top of their rent and utilities, to finally think about buying a home or starting a family or starting a business,” Biden stated.

And while earlier reports revealed that about 13 states could still tax borrowers on the amount of debt forgiven, Mississippi and Virginia are the latest to come off that original list as officials said they would refrain from levying taxes on individuals who receive loan forgiveness.

Nearly 8 million borrowers may be eligible to receive relief automatically because relevant income data is already available to the U.S. Department of Education. If the U.S. Department of Education doesn’t have your income data, the Administration will launch a simple application available by early October. Once borrowers complete the application, they can expect relief within 4 to 6 weeks.

The Department of Education will continue to process applications as they are received, even after the pause expires on December 31, 2022.

Relief may not include ‘commercially held FFEL loans.’

Currently, the U.S. Department of Education is saying that loans qualify if they are held by the Department. However, loans or debt provided by banks and nonprofit lenders, under the Federal Family Education Loan (FFEL) program do not qualify for forgiveness. That program that began in the 1960s was eliminated in 2010 after lawmakers argued that it would be cheaper and simpler to directly lend to students. Nearly 10 million people still hold FFEL loans, education officials say.

But some of those FFEL loans are still held by the U.S. government. Officials say when these loans go into default, the private companies that previously owned them transfer them over to a guarantee agency that services the debt on behalf of the federal government. The other reason is that the government bought back some of the loans during the 2008 credit crisis.

Borrowers eager to know where their FFEL loans are held can go to Studentaid.gov and sign in with your FSA ID. Then go to the “My Aid” tab, and search for your loans.

U.S. officials say even if your FFEL loan is commercially held, all hope may not be lost.

A spokesperson for the U.S Department of Education said borrowers with those loans can call their servicer and consolidate them into the Direct Loan Program to become eligible for forgiveness.

There’s currently no deadline by which they need to do this, but experts recommend borrowers in this situation act quickly.